Introduction

Have you ever wondered why you handle money the way you do? Whether you’re a spender, saver, or somewhere in between, your financial habits are deeply rooted in psychology. Understanding these behaviours can help you take control of your financial future.

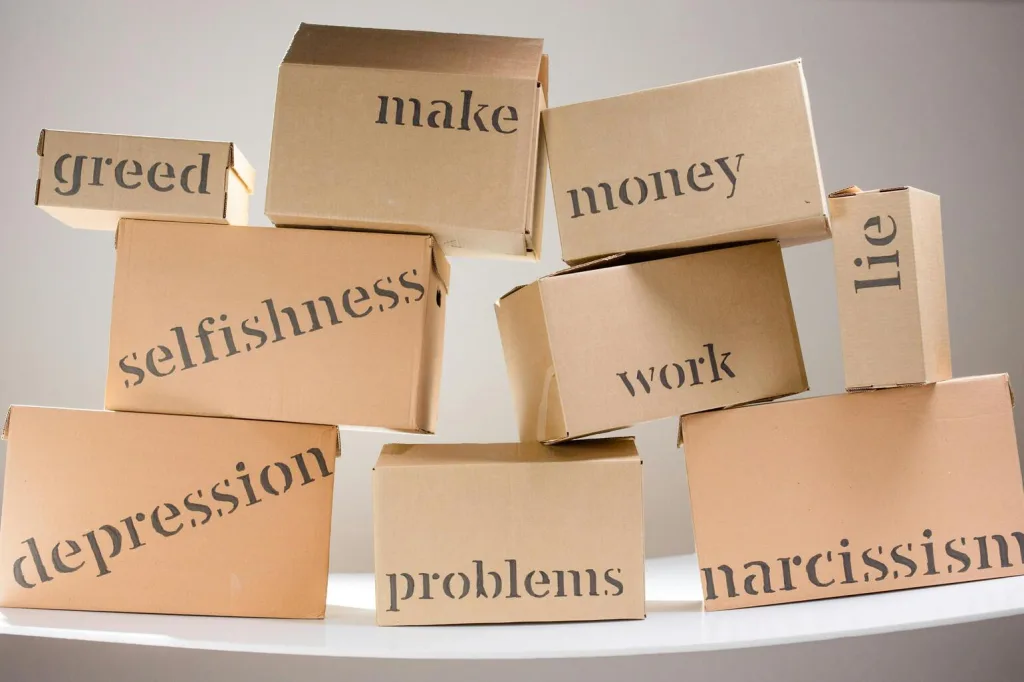

Common Psychological Biases in Money Management

1. The Anchoring Effect

Have you ever bought something on sale and felt like you got a great deal, even if you didn’t need it? That’s the anchoring effect at play. This bias leads us to rely heavily on the first piece of information we receive (like the original price) when making decisions.

2. Loss Aversion

Losses tend to hurt more than equivalent gains feel good. For instance, the pain of losing $50 is stronger than the pleasure of gaining $50. This fear of loss can make people overly cautious, avoiding investments that could grow their wealth.

3. Mental Accounting

Do you treat money differently depending on its source? For example, you might splurge with a tax refund but hesitate to spend your regular paycheque. This behaviour, known as mental accounting, can hinder smart financial decision-making.

The Role of Habits in Financial Health

Creating Healthy Spending Habits

Start by tracking your expenses. Small daily habits, like brewing coffee at home, can lead to significant savings over time. Tools like the 50/30/20 Rule can guide your budgeting efforts.

Building a Savings Mindset

Setting up automatic transfers to a savings account ensures you pay yourself first. Over time, this habit becomes second nature, helping you prepare for emergencies and future goals. Check out our guide on building an emergency fund.

Impulse Spending and How to Curb It

Impulse purchases are a common financial pitfall. Understanding the triggers behind these buys—like stress or boredom—can help you develop strategies to avoid them. For more tips, read about the psychology of spending.

How Mindset Shapes Investment Choices

Risk Tolerance and Perceived Safety

Your comfort with risk plays a huge role in your investment strategy. Those with a high-risk tolerance may lean toward stocks, while conservative investors prefer bonds or savings accounts.

Overcoming Fear of Investing

Fear often stems from a lack of knowledge. Start small and educate yourself. Begin with our beginner’s guide to investing to ease into the world of investments.

The Influence of Social Comparisons

Seeing friends or family flaunt their latest purchases can lead to “keeping up with the Joneses.” This behaviour often results in unnecessary debt. Remember, their financial journey is not yours.

Strategies for a Healthier Money Mindset

- Set Clear Financial Goals

Break your goals into short-term, mid-term, and long-term objectives. Whether it’s saving for a vacation or planning retirement, having a clear target keeps you motivated. - Educate Yourself

Knowledge is power. Read books, take courses, or explore blogs like Komnect.com to make informed decisions. - Practice Gratitude

Recognize and appreciate what you already have. Gratitude can shift your mindset from scarcity to abundance, reducing the urge to spend unnecessarily.

Conclusion

Understanding the psychology behind your financial habits is the first step to mastering them. By recognizing biases, building healthy habits, and setting clear goals, you can take charge of your financial destiny.

I have 13 years of experience in customer service at one of Brazil’s largest banks, including 5 years as a general branch manager. I am a specialist in banking products and services with a proven track record in team leadership and business development. I am also a holder of Brazilian certifications CPA-10 and CPA-20.